How To Measure Product-Market Fit

A more practical, less mythical way to measure product market fit.

Oct 19, 2023

Product-Market Fit, also known as Product Market Fit, Product/Market Fit or PMF, is one of the most widely debated concepts in the startup and tech community. In fact, perhaps the only topic more hotly debated is how to measure product market fit.

Personally, I’ve always found the concept of product-market fit quite magical, yet frustratingly mythical.

Magical because it defines the point at which a startup graduates from “searching for a product” into a having a great product that they can begin to scale a business around. In other words, it is the the most existential question of not just tech startups, but of all new businesses.

Given the importance of this inflection point and the fact that it impacts every startup in existence, one might expect that metrics and methods for identifying how to measure product market fit would be mature and universally accepted. But they are not.

Instead, founders find themselves baffled by conflicting opinions, anecdotes and mythical stories of how product-market fit should "feel." This is simply not helpful to founders.

What the startup community needs is a tangible and actionable combination of metrics that can demystify product-market fit and lay the foundation for a road map of how to get to it. This article and my accompanying free how to measure product market fit book are my attempts to provide just that.

Read on for my simple but unique perspective on how to approach the question of measuring product-market fit, and a guide to measuring the metrics that matter.

What is Product-Market Fit?

In this article, I will summarize some of the most insightful definitions, but I’ll also offer a distinctly different and I believe better perspective on understanding product-market fit. This approach will assist you in making actionable decisions for your startup.

Popular Definitions of Product Market Fit

From Andy Rachleff, who originally coined the term Product-Market Fit

“If the customer doesn't scream,you don't have product-market fit.”

In his interview with Venture Capitalist Mike Maples, The Co-founder of Benchmark Capital & Wealthfront tells the story of how the vague notion of product-market fit arose among his peers as a term for a specific sensation that arises when a startup appears to have unlocked the secret to creating a new product that deeply resonates with its target audience.

In Andy's recollection, the phrase arose to attempt to label the special sauce that preceded a startup taking off. Originally, it really was just a feeling that Andy and his peers noticed and began discussing.

From Marc Andreessen, who popularized the term Product-Market Fit

While Andy Rachleff is credited with originally coining the term, The famed Venture Capitalist Marc Andreessen is widely recognized for popularizing it in his blog post titled "The only thing that matters."

"Product/market fit means being in a good market with a product that can satisfy that market."

In the article, Marc emphasizes the importance of product-market fit and why it is a priority for businesses. However, he did not venture further into a detailed explanation of what the term actually means or how to measure it. This article generated significant excitement for the concept of product-market fit, while leaving the door open on how to actually define and measure it.

How to measure product market fit

Given the importance yet vagueness of the term, others in the startup world have attempted to find a more quantifiable method to evaluate it for themselves:

From Sean Ellis, who proposed how to quantify it

"Achieving product/market fit requires at least 40% of users saying they would be “very disappointed” without your product."

One of the most popular evaluation methods comes from Sean Ellis (who also coined the term "Growth Hacking") in 2009 Ellis aimed to make the concept of product-market fit less abstract by offering a specific metric.

"I’ve tried to make the concept less abstract by offering a specific metric for determining product/market fit.

I ask existing users of a product how they would feel if they could no longer use the product. In my experience, achieving product/market fit requires at least 40% of users saying they would be “very disappointed” without your product.

Admittedly this threshold is a bit arbitrary, but I defined it after comparing results across nearly 100 startups. Those that struggle for traction are always under 40%, while most that gain strong traction exceed 40%."

As Sean himself notes, the 40% number may be somewhat arbitrary, so it is more of a correlation than a causation. In other words, if you have product market fit, you may see a 40% response rate, but a 40% response rate does not necessarily mean that you have achieved PMF.

However, it did inspire many operators and writers who further developed the model, to the point where it became known as "The Sean Ellis Test."

From Rahul Vohra, who operationalized it

One founder inspired by The Ellis Test was Rahul, the founder of Superhuman. He used the Ellis Test as a tool to help propel his own company towards achieving Product-Market Fit. His story, published in First Round Review, became a widely popular and frequently referenced guide for founders.

Vohra's decision to choose The Ellis Test appears to be driven by his understanding that he needed a leading indicator of Product-Market Fit that could be observed before launching, rather than a lagging indicator that can only be assessed after launching and gaining exposure to multiple users.

"That’s because the descriptions of product/market fit I found were immensely helpful for companies post-launch.

If, after launch, revenue isn’t growing, raising money is tough, the press doesn't want to talk to you and user growth is anemic, then you can safely conclude you don't have product/market fit.

But in practice, because of my previous success as a founder, we didn’t have problems raising money. We could have gotten press, but we were actively avoiding it. And user growth wasn't happening because we deliberately choosing not to onboard more users. We were pre-launch — and we didn’t have any indicators to clearly illustrate our situation."

In my opinion, the success that Rahul describes is not only attributed to his deployment of the Ellis test and monitoring the results over time, but also to his combination of this approach with the "high expectation customers" model. By segmenting the feedback and prioritizing product improvements towards the most valuable customers, Rahul and Superhuman were able to achieve the desired outcome.

A more tangible, quantitative approach to product-market fit

Rather than providing another potential definition of product market fit, I suggest taking a different approach. Instead of focusing on the actual definition, I propose we reflect on why we are asking about it in the first place.

The intention matters more than the definition

In other words, rather than trying to reconcile different definitions of the phrase, it is more useful to consider why people are so interested in product-market fit in the first place?

Why DO so many people inquire about product-market fit if they don't understand it?

Why is Product-market Fit Important?

When a founder or investor questions whether a startup has product-market fit, they are really asking this:

"is this product ready to scale?"

This is a critical question because if the product is not quite suitable for the target audience, any attempts to scale will be inefficient, wasteful, or even destructive to the startup.

When the proposition and messaging don't resonate with the audience, marketing distribution efforts will be inefficient and advertising wasteful.

When the product doesn't sufficiently solve a user's problem, retention will be poor and churn will be high.

When overall satisfaction is not achieved, customers won't recommend the product to their friends, hindering referrals.

In such a state, accelerating growth by scaling marketing can actually expedite the downfall of a company by depleting runway faster than the revenue can sustain it.

I believe this is what Marc Andreessen was referring to when he wrote that "before PMF" (product-market fit)...

"When you are (Before Product/Market Fit), focus obsessively on getting to product/market fit.

Do whatever is required to get to product/market fit. Including changing out people, rewriting your product, moving into a different market, telling customers no when you don’t want to, telling customers yes when you don’t want to, raising that fourth round of highly dilutive venture capital—whatever is required.

When you get right down to it, you can ignore almost everything else"

Therefore, a helpful approach for how to measure product market fit is to quantify whether the product is ready to scale. And unlike many of the more abstract and mythical descriptions of product-market fit, this approach is more tangible and actionable for your startup.

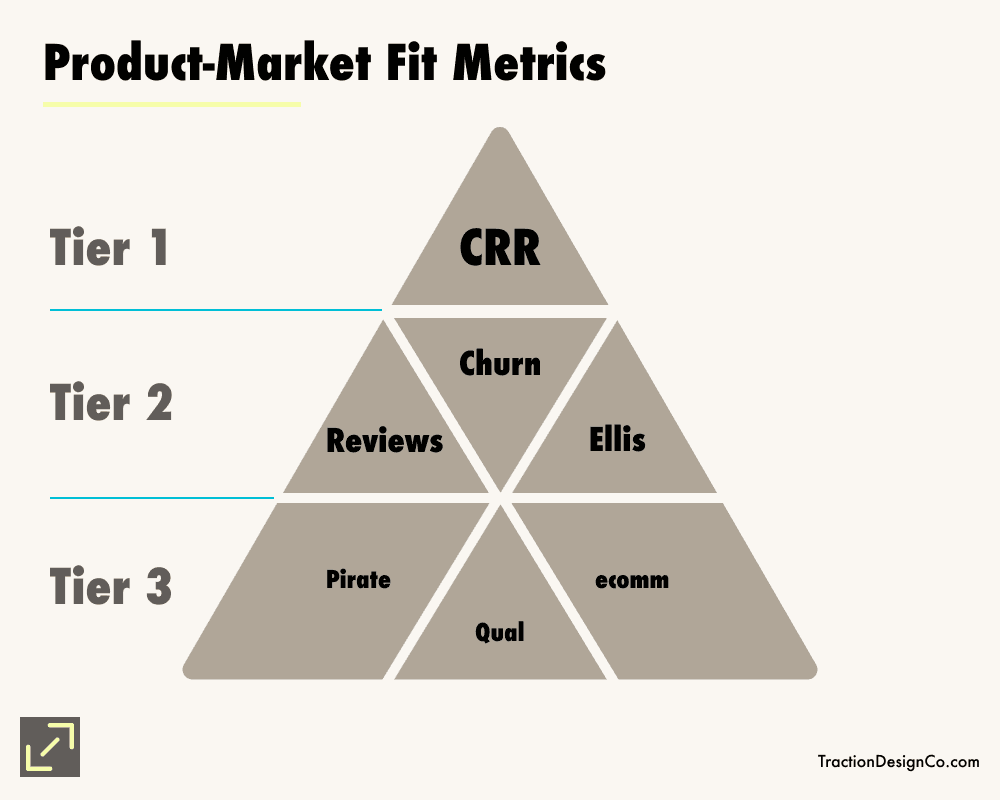

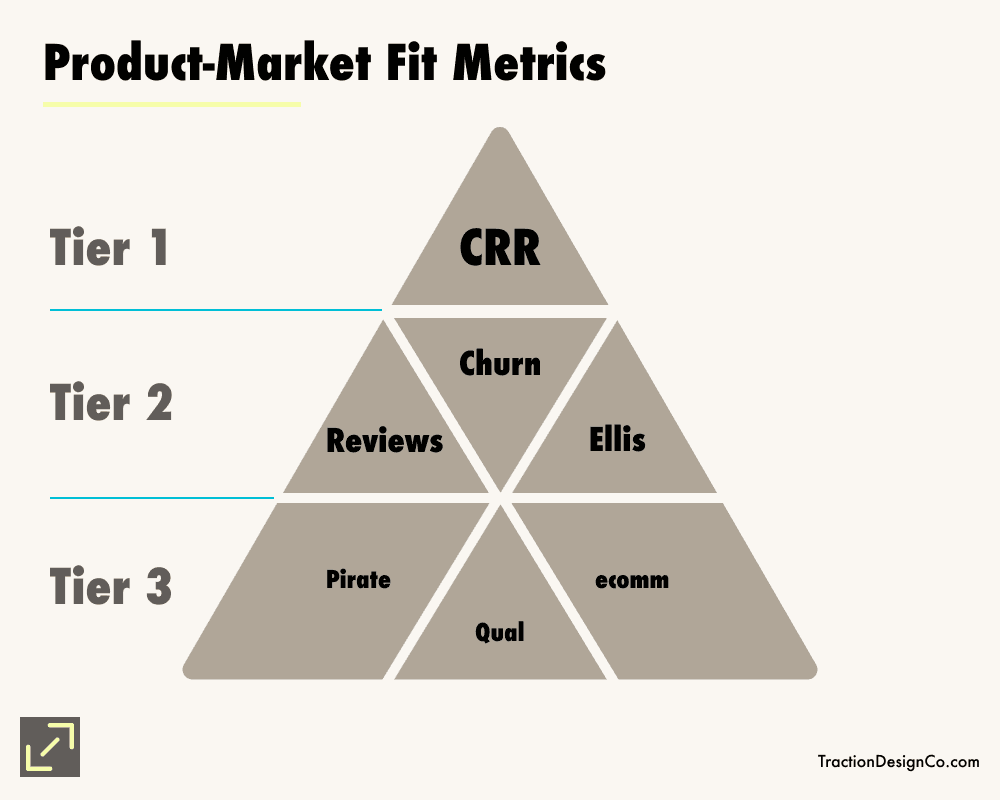

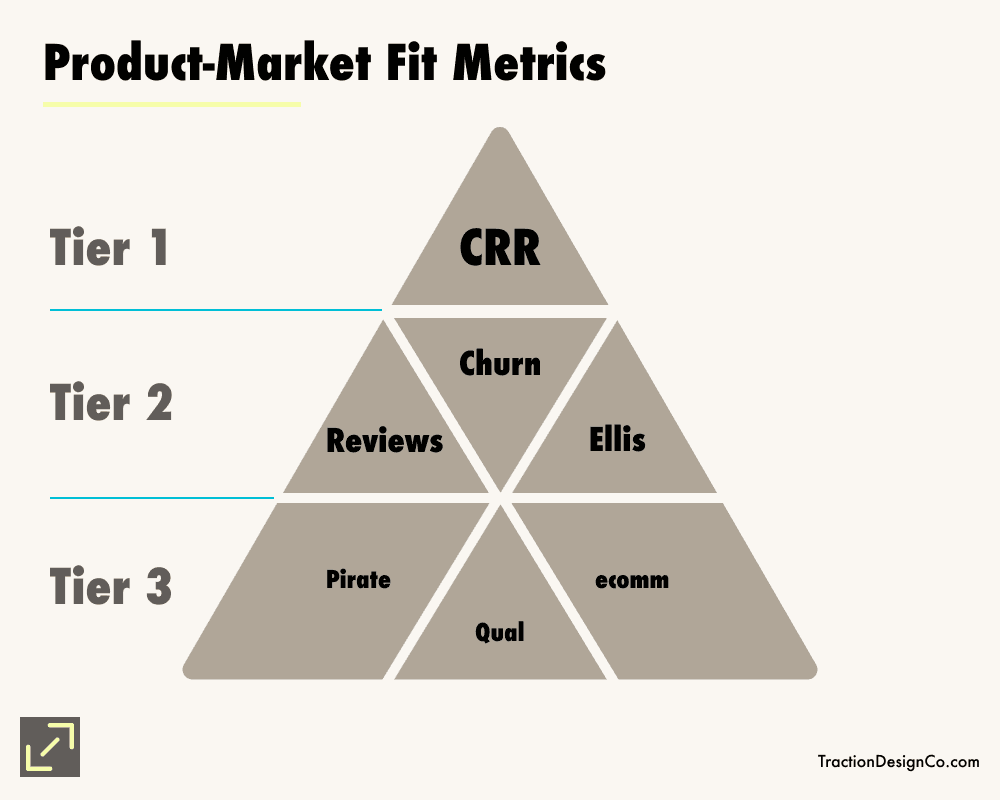

How To Measure Product-Market Fit with Tangible Metrics

To assess whether your product is ready to scale and achieve product-market fit (PMF), there are several tangible signals that you may already be tracking within your business. These include metrics such as referral rate, retention, and conversion.

Let's prioritize these signals based on their importance and relevance to PMF.

The Product-Market Fit Metrics Pyramid

Tier 1: The most important metric is Customer Referral Rate

What is Customer Referral Rate?

Customer Referral Rate (CRR) is a valuable metric that measures the effectiveness of a business in growing through referrals from existing customers.

Why is this metric important for measuring product market fit?

A high referral rate indicates customer satisfaction with your product to the extent that they have actually recommended it to others.

Now. Consider all the factors that must be true for a customer to actively refer your product to a friend:

They were convinced by your messaging and decided to purchase your product in the first place.

They are satisfied with the value provided by your product, justifying its price.

They are excited enough about your product to think of a friend or peer who might also find value in it.

They are willing to vouch for your product to their friend, understanding that their peer may be disappointed and unhappy with them if they don't like it.

They are willing to put in the effort to make the recommendation, rather than just thinking about it.

If your referral rate is strong and not artificially inflated through incentives, growth hacks, or tricks, it is difficult for someone to argue that your product lacks product-market fit. The more organic the referrals, the better.

This sentiment was also highlighted by Andy Rachleff in his interview with Mike Maples:

"Another indicator is when customers start referring your product to others without any prompting."

How to measure customer referral rate (CRR)

To calculate your customer referral rate, you need to follow these steps:

Identify the number of referrals:

Determine the number of new customers who joined through referrals during a specific period (e.g., a month, a quarter, or a year).Identify the total number of customers:

Determine the total number of customers at the start of the same period.Calculate the customer referral rate using the formula:

Customer Referral Rate (CRR) = (Number of Referrals / Total Number of Customers) * 100

For example, if you had 100 customers at the beginning of the month and you acquired 10 new customers through referrals during that month, the customer referral rate would be CRR = (10 / 100) * 100 = 10%.

This means that 10% of your existing customers referred at least one new customer during the month.

What is a good customer referral rate?

The best way for a business to benchmark is against industry averages and competitors. Here are some recent averages for a few select categories. Make sure to check recent benchmarks specific to your own category.

B2B SaaS - 5-15% is a typical range. 20%+ is excellent.

Enterprise SaaS - 10-20% referral rate on average. 25%+ is very strong.

Consumer ecommerce - 2-5% is average. 10%+ is considered high.

Marketplaces - 5-15% is common. 20%+ is a high bar.

Financial services - 1-3% is average for banks/lenders. Over 5% is very good.

Digital media properties - 10-20% is common. 30%+ indicates viral growth.

Mobile apps - 5-12% baseline rate. 25%+ is rare and impressive.

B2B services - 8-12% is solid for professional services. Above 15% is strong.

Retail stores - 2-7% is average. Over 10% is difficult to sustain.

Software companies - 10-20%+ driven by word-of-mouth advocates.

Important!

When measuring referral rates, isolate the authentic referrals separately from those prompted by incentives. Modest incentives are fine, but over-incentivization artificially inflates metrics.

True product-market fit is best reflected by customers voluntarily spreading awareness out of genuine enthusiasm, not excessive perks. Their willingness to refer organically signals the resonance needed to drive growth through referrals.

Therefore, be sure to distinguish authentic word-of-mouth advocacy from bought referrals when assessing product-market fit.

But what if customer referrals are not feasible for your business?

There are certain products where referrals are less likely compared to others. In some cases, a unique and eye-catching piece of clothing can generate conversations among friends and even strangers, resulting in rapid organic growth. On the other hand, a medication for ED or a similarly private product may not be something a customer feels comfortable discussing with their peers.

Nevertheless, the talkability of your product can still impact referral rates, even in less extreme scenarios.

So if you have questions about your Customer Referral Rate, consider examining the following lower-tier indicators.

Learn more about how to measure product market fit

This is article is just an extract from my new how to measure product-market fit book, which you can download for free now.

In this free 24-page PDF guide I explain all 3 tiers of product-market fit metrics, how to measure them and what some reasonable product-market fit example benchmarks may be for both B2B SaaS and B2C ecommerce businesses.

I also address the role of Net Promoter Score, whether you should juice & incentivize metrics and issue other important caveats that you need to consider.

Download your copy for free now.

Still not sure if you have product-market fit?

If this article and the free product-market fit book still leave you wondering whether you have product-market fit and how to measure it, get in touch and I'd be happy to discuss it with you.

I'm offering a free 1-hour product-market fit workshop for readers of the How to Measure Product Market Fit book, which can be accessed by the Calendly link within.

You can also contact me directly here through the website or follow me on LinkedIn or Twitter to discuss further.

Product-Market Fit, also known as Product Market Fit, Product/Market Fit or PMF, is one of the most widely debated concepts in the startup and tech community. In fact, perhaps the only topic more hotly debated is how to measure product market fit.

Personally, I’ve always found the concept of product-market fit quite magical, yet frustratingly mythical.

Magical because it defines the point at which a startup graduates from “searching for a product” into a having a great product that they can begin to scale a business around. In other words, it is the the most existential question of not just tech startups, but of all new businesses.

Given the importance of this inflection point and the fact that it impacts every startup in existence, one might expect that metrics and methods for identifying how to measure product market fit would be mature and universally accepted. But they are not.

Instead, founders find themselves baffled by conflicting opinions, anecdotes and mythical stories of how product-market fit should "feel." This is simply not helpful to founders.

What the startup community needs is a tangible and actionable combination of metrics that can demystify product-market fit and lay the foundation for a road map of how to get to it. This article and my accompanying free how to measure product market fit book are my attempts to provide just that.

Read on for my simple but unique perspective on how to approach the question of measuring product-market fit, and a guide to measuring the metrics that matter.

What is Product-Market Fit?

In this article, I will summarize some of the most insightful definitions, but I’ll also offer a distinctly different and I believe better perspective on understanding product-market fit. This approach will assist you in making actionable decisions for your startup.

Popular Definitions of Product Market Fit

From Andy Rachleff, who originally coined the term Product-Market Fit

“If the customer doesn't scream,you don't have product-market fit.”

In his interview with Venture Capitalist Mike Maples, The Co-founder of Benchmark Capital & Wealthfront tells the story of how the vague notion of product-market fit arose among his peers as a term for a specific sensation that arises when a startup appears to have unlocked the secret to creating a new product that deeply resonates with its target audience.

In Andy's recollection, the phrase arose to attempt to label the special sauce that preceded a startup taking off. Originally, it really was just a feeling that Andy and his peers noticed and began discussing.

From Marc Andreessen, who popularized the term Product-Market Fit

While Andy Rachleff is credited with originally coining the term, The famed Venture Capitalist Marc Andreessen is widely recognized for popularizing it in his blog post titled "The only thing that matters."

"Product/market fit means being in a good market with a product that can satisfy that market."

In the article, Marc emphasizes the importance of product-market fit and why it is a priority for businesses. However, he did not venture further into a detailed explanation of what the term actually means or how to measure it. This article generated significant excitement for the concept of product-market fit, while leaving the door open on how to actually define and measure it.

How to measure product market fit

Given the importance yet vagueness of the term, others in the startup world have attempted to find a more quantifiable method to evaluate it for themselves:

From Sean Ellis, who proposed how to quantify it

"Achieving product/market fit requires at least 40% of users saying they would be “very disappointed” without your product."

One of the most popular evaluation methods comes from Sean Ellis (who also coined the term "Growth Hacking") in 2009 Ellis aimed to make the concept of product-market fit less abstract by offering a specific metric.

"I’ve tried to make the concept less abstract by offering a specific metric for determining product/market fit.

I ask existing users of a product how they would feel if they could no longer use the product. In my experience, achieving product/market fit requires at least 40% of users saying they would be “very disappointed” without your product.

Admittedly this threshold is a bit arbitrary, but I defined it after comparing results across nearly 100 startups. Those that struggle for traction are always under 40%, while most that gain strong traction exceed 40%."

As Sean himself notes, the 40% number may be somewhat arbitrary, so it is more of a correlation than a causation. In other words, if you have product market fit, you may see a 40% response rate, but a 40% response rate does not necessarily mean that you have achieved PMF.

However, it did inspire many operators and writers who further developed the model, to the point where it became known as "The Sean Ellis Test."

From Rahul Vohra, who operationalized it

One founder inspired by The Ellis Test was Rahul, the founder of Superhuman. He used the Ellis Test as a tool to help propel his own company towards achieving Product-Market Fit. His story, published in First Round Review, became a widely popular and frequently referenced guide for founders.

Vohra's decision to choose The Ellis Test appears to be driven by his understanding that he needed a leading indicator of Product-Market Fit that could be observed before launching, rather than a lagging indicator that can only be assessed after launching and gaining exposure to multiple users.

"That’s because the descriptions of product/market fit I found were immensely helpful for companies post-launch.

If, after launch, revenue isn’t growing, raising money is tough, the press doesn't want to talk to you and user growth is anemic, then you can safely conclude you don't have product/market fit.

But in practice, because of my previous success as a founder, we didn’t have problems raising money. We could have gotten press, but we were actively avoiding it. And user growth wasn't happening because we deliberately choosing not to onboard more users. We were pre-launch — and we didn’t have any indicators to clearly illustrate our situation."

In my opinion, the success that Rahul describes is not only attributed to his deployment of the Ellis test and monitoring the results over time, but also to his combination of this approach with the "high expectation customers" model. By segmenting the feedback and prioritizing product improvements towards the most valuable customers, Rahul and Superhuman were able to achieve the desired outcome.

A more tangible, quantitative approach to product-market fit

Rather than providing another potential definition of product market fit, I suggest taking a different approach. Instead of focusing on the actual definition, I propose we reflect on why we are asking about it in the first place.

The intention matters more than the definition

In other words, rather than trying to reconcile different definitions of the phrase, it is more useful to consider why people are so interested in product-market fit in the first place?

Why DO so many people inquire about product-market fit if they don't understand it?

Why is Product-market Fit Important?

When a founder or investor questions whether a startup has product-market fit, they are really asking this:

"is this product ready to scale?"

This is a critical question because if the product is not quite suitable for the target audience, any attempts to scale will be inefficient, wasteful, or even destructive to the startup.

When the proposition and messaging don't resonate with the audience, marketing distribution efforts will be inefficient and advertising wasteful.

When the product doesn't sufficiently solve a user's problem, retention will be poor and churn will be high.

When overall satisfaction is not achieved, customers won't recommend the product to their friends, hindering referrals.

In such a state, accelerating growth by scaling marketing can actually expedite the downfall of a company by depleting runway faster than the revenue can sustain it.

I believe this is what Marc Andreessen was referring to when he wrote that "before PMF" (product-market fit)...

"When you are (Before Product/Market Fit), focus obsessively on getting to product/market fit.

Do whatever is required to get to product/market fit. Including changing out people, rewriting your product, moving into a different market, telling customers no when you don’t want to, telling customers yes when you don’t want to, raising that fourth round of highly dilutive venture capital—whatever is required.

When you get right down to it, you can ignore almost everything else"

Therefore, a helpful approach for how to measure product market fit is to quantify whether the product is ready to scale. And unlike many of the more abstract and mythical descriptions of product-market fit, this approach is more tangible and actionable for your startup.

How To Measure Product-Market Fit with Tangible Metrics

To assess whether your product is ready to scale and achieve product-market fit (PMF), there are several tangible signals that you may already be tracking within your business. These include metrics such as referral rate, retention, and conversion.

Let's prioritize these signals based on their importance and relevance to PMF.

The Product-Market Fit Metrics Pyramid

Tier 1: The most important metric is Customer Referral Rate

What is Customer Referral Rate?

Customer Referral Rate (CRR) is a valuable metric that measures the effectiveness of a business in growing through referrals from existing customers.

Why is this metric important for measuring product market fit?

A high referral rate indicates customer satisfaction with your product to the extent that they have actually recommended it to others.

Now. Consider all the factors that must be true for a customer to actively refer your product to a friend:

They were convinced by your messaging and decided to purchase your product in the first place.

They are satisfied with the value provided by your product, justifying its price.

They are excited enough about your product to think of a friend or peer who might also find value in it.

They are willing to vouch for your product to their friend, understanding that their peer may be disappointed and unhappy with them if they don't like it.

They are willing to put in the effort to make the recommendation, rather than just thinking about it.

If your referral rate is strong and not artificially inflated through incentives, growth hacks, or tricks, it is difficult for someone to argue that your product lacks product-market fit. The more organic the referrals, the better.

This sentiment was also highlighted by Andy Rachleff in his interview with Mike Maples:

"Another indicator is when customers start referring your product to others without any prompting."

How to measure customer referral rate (CRR)

To calculate your customer referral rate, you need to follow these steps:

Identify the number of referrals:

Determine the number of new customers who joined through referrals during a specific period (e.g., a month, a quarter, or a year).Identify the total number of customers:

Determine the total number of customers at the start of the same period.Calculate the customer referral rate using the formula:

Customer Referral Rate (CRR) = (Number of Referrals / Total Number of Customers) * 100

For example, if you had 100 customers at the beginning of the month and you acquired 10 new customers through referrals during that month, the customer referral rate would be CRR = (10 / 100) * 100 = 10%.

This means that 10% of your existing customers referred at least one new customer during the month.

What is a good customer referral rate?

The best way for a business to benchmark is against industry averages and competitors. Here are some recent averages for a few select categories. Make sure to check recent benchmarks specific to your own category.

B2B SaaS - 5-15% is a typical range. 20%+ is excellent.

Enterprise SaaS - 10-20% referral rate on average. 25%+ is very strong.

Consumer ecommerce - 2-5% is average. 10%+ is considered high.

Marketplaces - 5-15% is common. 20%+ is a high bar.

Financial services - 1-3% is average for banks/lenders. Over 5% is very good.

Digital media properties - 10-20% is common. 30%+ indicates viral growth.

Mobile apps - 5-12% baseline rate. 25%+ is rare and impressive.

B2B services - 8-12% is solid for professional services. Above 15% is strong.

Retail stores - 2-7% is average. Over 10% is difficult to sustain.

Software companies - 10-20%+ driven by word-of-mouth advocates.

Important!

When measuring referral rates, isolate the authentic referrals separately from those prompted by incentives. Modest incentives are fine, but over-incentivization artificially inflates metrics.

True product-market fit is best reflected by customers voluntarily spreading awareness out of genuine enthusiasm, not excessive perks. Their willingness to refer organically signals the resonance needed to drive growth through referrals.

Therefore, be sure to distinguish authentic word-of-mouth advocacy from bought referrals when assessing product-market fit.

But what if customer referrals are not feasible for your business?

There are certain products where referrals are less likely compared to others. In some cases, a unique and eye-catching piece of clothing can generate conversations among friends and even strangers, resulting in rapid organic growth. On the other hand, a medication for ED or a similarly private product may not be something a customer feels comfortable discussing with their peers.

Nevertheless, the talkability of your product can still impact referral rates, even in less extreme scenarios.

So if you have questions about your Customer Referral Rate, consider examining the following lower-tier indicators.

Learn more about how to measure product market fit

This is article is just an extract from my new how to measure product-market fit book, which you can download for free now.

In this free 24-page PDF guide I explain all 3 tiers of product-market fit metrics, how to measure them and what some reasonable product-market fit example benchmarks may be for both B2B SaaS and B2C ecommerce businesses.

I also address the role of Net Promoter Score, whether you should juice & incentivize metrics and issue other important caveats that you need to consider.

Download your copy for free now.

Still not sure if you have product-market fit?

If this article and the free product-market fit book still leave you wondering whether you have product-market fit and how to measure it, get in touch and I'd be happy to discuss it with you.

I'm offering a free 1-hour product-market fit workshop for readers of the How to Measure Product Market Fit book, which can be accessed by the Calendly link within.

You can also contact me directly here through the website or follow me on LinkedIn or Twitter to discuss further.

Product-Market Fit, also known as Product Market Fit, Product/Market Fit or PMF, is one of the most widely debated concepts in the startup and tech community. In fact, perhaps the only topic more hotly debated is how to measure product market fit.

Personally, I’ve always found the concept of product-market fit quite magical, yet frustratingly mythical.

Magical because it defines the point at which a startup graduates from “searching for a product” into a having a great product that they can begin to scale a business around. In other words, it is the the most existential question of not just tech startups, but of all new businesses.

Given the importance of this inflection point and the fact that it impacts every startup in existence, one might expect that metrics and methods for identifying how to measure product market fit would be mature and universally accepted. But they are not.

Instead, founders find themselves baffled by conflicting opinions, anecdotes and mythical stories of how product-market fit should "feel." This is simply not helpful to founders.

What the startup community needs is a tangible and actionable combination of metrics that can demystify product-market fit and lay the foundation for a road map of how to get to it. This article and my accompanying free how to measure product market fit book are my attempts to provide just that.

Read on for my simple but unique perspective on how to approach the question of measuring product-market fit, and a guide to measuring the metrics that matter.

What is Product-Market Fit?

In this article, I will summarize some of the most insightful definitions, but I’ll also offer a distinctly different and I believe better perspective on understanding product-market fit. This approach will assist you in making actionable decisions for your startup.

Popular Definitions of Product Market Fit

From Andy Rachleff, who originally coined the term Product-Market Fit

“If the customer doesn't scream,you don't have product-market fit.”

In his interview with Venture Capitalist Mike Maples, The Co-founder of Benchmark Capital & Wealthfront tells the story of how the vague notion of product-market fit arose among his peers as a term for a specific sensation that arises when a startup appears to have unlocked the secret to creating a new product that deeply resonates with its target audience.

In Andy's recollection, the phrase arose to attempt to label the special sauce that preceded a startup taking off. Originally, it really was just a feeling that Andy and his peers noticed and began discussing.

From Marc Andreessen, who popularized the term Product-Market Fit

While Andy Rachleff is credited with originally coining the term, The famed Venture Capitalist Marc Andreessen is widely recognized for popularizing it in his blog post titled "The only thing that matters."

"Product/market fit means being in a good market with a product that can satisfy that market."

In the article, Marc emphasizes the importance of product-market fit and why it is a priority for businesses. However, he did not venture further into a detailed explanation of what the term actually means or how to measure it. This article generated significant excitement for the concept of product-market fit, while leaving the door open on how to actually define and measure it.

How to measure product market fit

Given the importance yet vagueness of the term, others in the startup world have attempted to find a more quantifiable method to evaluate it for themselves:

From Sean Ellis, who proposed how to quantify it

"Achieving product/market fit requires at least 40% of users saying they would be “very disappointed” without your product."

One of the most popular evaluation methods comes from Sean Ellis (who also coined the term "Growth Hacking") in 2009 Ellis aimed to make the concept of product-market fit less abstract by offering a specific metric.

"I’ve tried to make the concept less abstract by offering a specific metric for determining product/market fit.

I ask existing users of a product how they would feel if they could no longer use the product. In my experience, achieving product/market fit requires at least 40% of users saying they would be “very disappointed” without your product.

Admittedly this threshold is a bit arbitrary, but I defined it after comparing results across nearly 100 startups. Those that struggle for traction are always under 40%, while most that gain strong traction exceed 40%."

As Sean himself notes, the 40% number may be somewhat arbitrary, so it is more of a correlation than a causation. In other words, if you have product market fit, you may see a 40% response rate, but a 40% response rate does not necessarily mean that you have achieved PMF.

However, it did inspire many operators and writers who further developed the model, to the point where it became known as "The Sean Ellis Test."

From Rahul Vohra, who operationalized it

One founder inspired by The Ellis Test was Rahul, the founder of Superhuman. He used the Ellis Test as a tool to help propel his own company towards achieving Product-Market Fit. His story, published in First Round Review, became a widely popular and frequently referenced guide for founders.

Vohra's decision to choose The Ellis Test appears to be driven by his understanding that he needed a leading indicator of Product-Market Fit that could be observed before launching, rather than a lagging indicator that can only be assessed after launching and gaining exposure to multiple users.

"That’s because the descriptions of product/market fit I found were immensely helpful for companies post-launch.

If, after launch, revenue isn’t growing, raising money is tough, the press doesn't want to talk to you and user growth is anemic, then you can safely conclude you don't have product/market fit.

But in practice, because of my previous success as a founder, we didn’t have problems raising money. We could have gotten press, but we were actively avoiding it. And user growth wasn't happening because we deliberately choosing not to onboard more users. We were pre-launch — and we didn’t have any indicators to clearly illustrate our situation."

In my opinion, the success that Rahul describes is not only attributed to his deployment of the Ellis test and monitoring the results over time, but also to his combination of this approach with the "high expectation customers" model. By segmenting the feedback and prioritizing product improvements towards the most valuable customers, Rahul and Superhuman were able to achieve the desired outcome.

A more tangible, quantitative approach to product-market fit

Rather than providing another potential definition of product market fit, I suggest taking a different approach. Instead of focusing on the actual definition, I propose we reflect on why we are asking about it in the first place.

The intention matters more than the definition

In other words, rather than trying to reconcile different definitions of the phrase, it is more useful to consider why people are so interested in product-market fit in the first place?

Why DO so many people inquire about product-market fit if they don't understand it?

Why is Product-market Fit Important?

When a founder or investor questions whether a startup has product-market fit, they are really asking this:

"is this product ready to scale?"

This is a critical question because if the product is not quite suitable for the target audience, any attempts to scale will be inefficient, wasteful, or even destructive to the startup.

When the proposition and messaging don't resonate with the audience, marketing distribution efforts will be inefficient and advertising wasteful.

When the product doesn't sufficiently solve a user's problem, retention will be poor and churn will be high.

When overall satisfaction is not achieved, customers won't recommend the product to their friends, hindering referrals.

In such a state, accelerating growth by scaling marketing can actually expedite the downfall of a company by depleting runway faster than the revenue can sustain it.

I believe this is what Marc Andreessen was referring to when he wrote that "before PMF" (product-market fit)...

"When you are (Before Product/Market Fit), focus obsessively on getting to product/market fit.

Do whatever is required to get to product/market fit. Including changing out people, rewriting your product, moving into a different market, telling customers no when you don’t want to, telling customers yes when you don’t want to, raising that fourth round of highly dilutive venture capital—whatever is required.

When you get right down to it, you can ignore almost everything else"

Therefore, a helpful approach for how to measure product market fit is to quantify whether the product is ready to scale. And unlike many of the more abstract and mythical descriptions of product-market fit, this approach is more tangible and actionable for your startup.

How To Measure Product-Market Fit with Tangible Metrics

To assess whether your product is ready to scale and achieve product-market fit (PMF), there are several tangible signals that you may already be tracking within your business. These include metrics such as referral rate, retention, and conversion.

Let's prioritize these signals based on their importance and relevance to PMF.

The Product-Market Fit Metrics Pyramid

Tier 1: The most important metric is Customer Referral Rate

What is Customer Referral Rate?

Customer Referral Rate (CRR) is a valuable metric that measures the effectiveness of a business in growing through referrals from existing customers.

Why is this metric important for measuring product market fit?

A high referral rate indicates customer satisfaction with your product to the extent that they have actually recommended it to others.

Now. Consider all the factors that must be true for a customer to actively refer your product to a friend:

They were convinced by your messaging and decided to purchase your product in the first place.

They are satisfied with the value provided by your product, justifying its price.

They are excited enough about your product to think of a friend or peer who might also find value in it.

They are willing to vouch for your product to their friend, understanding that their peer may be disappointed and unhappy with them if they don't like it.

They are willing to put in the effort to make the recommendation, rather than just thinking about it.

If your referral rate is strong and not artificially inflated through incentives, growth hacks, or tricks, it is difficult for someone to argue that your product lacks product-market fit. The more organic the referrals, the better.

This sentiment was also highlighted by Andy Rachleff in his interview with Mike Maples:

"Another indicator is when customers start referring your product to others without any prompting."

How to measure customer referral rate (CRR)

To calculate your customer referral rate, you need to follow these steps:

Identify the number of referrals:

Determine the number of new customers who joined through referrals during a specific period (e.g., a month, a quarter, or a year).Identify the total number of customers:

Determine the total number of customers at the start of the same period.Calculate the customer referral rate using the formula:

Customer Referral Rate (CRR) = (Number of Referrals / Total Number of Customers) * 100

For example, if you had 100 customers at the beginning of the month and you acquired 10 new customers through referrals during that month, the customer referral rate would be CRR = (10 / 100) * 100 = 10%.

This means that 10% of your existing customers referred at least one new customer during the month.

What is a good customer referral rate?

The best way for a business to benchmark is against industry averages and competitors. Here are some recent averages for a few select categories. Make sure to check recent benchmarks specific to your own category.

B2B SaaS - 5-15% is a typical range. 20%+ is excellent.

Enterprise SaaS - 10-20% referral rate on average. 25%+ is very strong.

Consumer ecommerce - 2-5% is average. 10%+ is considered high.

Marketplaces - 5-15% is common. 20%+ is a high bar.

Financial services - 1-3% is average for banks/lenders. Over 5% is very good.

Digital media properties - 10-20% is common. 30%+ indicates viral growth.

Mobile apps - 5-12% baseline rate. 25%+ is rare and impressive.

B2B services - 8-12% is solid for professional services. Above 15% is strong.

Retail stores - 2-7% is average. Over 10% is difficult to sustain.

Software companies - 10-20%+ driven by word-of-mouth advocates.

Important!

When measuring referral rates, isolate the authentic referrals separately from those prompted by incentives. Modest incentives are fine, but over-incentivization artificially inflates metrics.

True product-market fit is best reflected by customers voluntarily spreading awareness out of genuine enthusiasm, not excessive perks. Their willingness to refer organically signals the resonance needed to drive growth through referrals.

Therefore, be sure to distinguish authentic word-of-mouth advocacy from bought referrals when assessing product-market fit.

But what if customer referrals are not feasible for your business?

There are certain products where referrals are less likely compared to others. In some cases, a unique and eye-catching piece of clothing can generate conversations among friends and even strangers, resulting in rapid organic growth. On the other hand, a medication for ED or a similarly private product may not be something a customer feels comfortable discussing with their peers.

Nevertheless, the talkability of your product can still impact referral rates, even in less extreme scenarios.

So if you have questions about your Customer Referral Rate, consider examining the following lower-tier indicators.

Learn more about how to measure product market fit

This is article is just an extract from my new how to measure product-market fit book, which you can download for free now.

In this free 24-page PDF guide I explain all 3 tiers of product-market fit metrics, how to measure them and what some reasonable product-market fit example benchmarks may be for both B2B SaaS and B2C ecommerce businesses.

I also address the role of Net Promoter Score, whether you should juice & incentivize metrics and issue other important caveats that you need to consider.

Download your copy for free now.

Still not sure if you have product-market fit?

If this article and the free product-market fit book still leave you wondering whether you have product-market fit and how to measure it, get in touch and I'd be happy to discuss it with you.

I'm offering a free 1-hour product-market fit workshop for readers of the How to Measure Product Market Fit book, which can be accessed by the Calendly link within.

You can also contact me directly here through the website or follow me on LinkedIn or Twitter to discuss further.

How to know if you have Product-Market Fit

Download the FREE expert guide on how to measure Product-Market Fit (PMF) for YOUR startup.